China’s cheap EV surge and booming exports aim to top Japan’s auto sales by 2025. Learn the key trends and market impacts now.

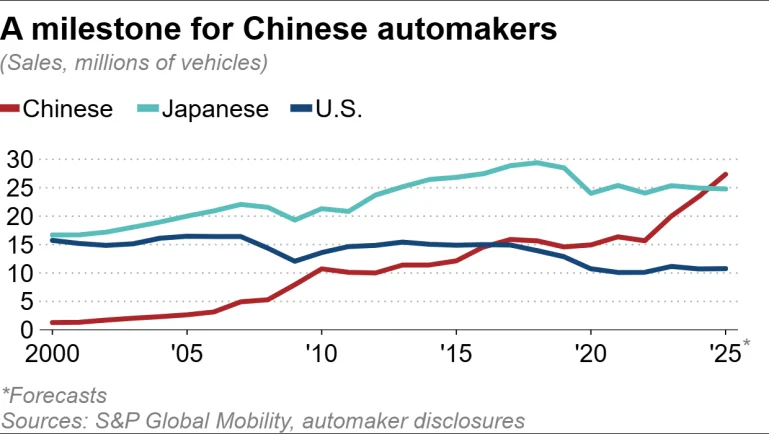

Chinese automakers are on the brink of a historic breakthrough. A joint analysis by *Nikkei* and *S&P Global Mobility* projects that China will sell about 27 million new vehicles in 2025 – a 17 % rise from this year – and overtake Japan, which is expected to stay below 25 million.

Domestic Powerhouse: Cheap EVs Drive Growth

More than 70 % of China’s total sales come from the home market, where the government is aggressively promoting battery‑electric (BEV) and plug‑in hybrid (PHEV) models. Nearly 60 % of passenger‑car sales are now electric, and the most common price band for new‑energy vehicles (NEVs) is ¥100,000‑¥150,000 (US$14,000‑$21,000), accounting for 23 % of all sales.

Export Engine Roars

China’s export volumes are expanding fast. Manufacturers are using aggressive pricing to push surplus EV inventory abroad, turning the export channel into a “deflationary” lever. In Southeast Asia, Chinese sales are forecast to jump 49 % to about 500,000 units, eroding the long‑standing dominance of Japanese brands whose market share in Thailand has slipped from roughly 90 % five years ago to 69 % as of November.

In Europe, Chinese car shipments are expected to rise 7 % to around 2.3 million units. Even with the EU’s anti‑subsidy duties on Chinese‑made EVs, Chinese firms are shifting more of their focus to PHEVs, which are exempt from the extra tax.

Emerging markets are seeing robust gains as well: African sales could grow 32 % to 230,000 vehicles, while Latin America (including the United States’ southern neighbour) may see a 33 % increase to roughly 540,000 units.

Japan’s Decline and Strategic Shifts

Japan’s global sales are projected to plateau below 25 million, a stark contrast to its peak of nearly 30 million in 2018. The slowdown is most visible in regions where Chinese brands are gaining ground – Southeast Asia and Europe – and in China itself, where Japanese makers have struggled to electrify their line‑ups quickly enough.

Some Japanese OEMs are beginning to adopt Chinese‑style production tactics. Nissan has started exporting low‑cost EVs developed under Chinese joint‑venture leadership, while Toyota is increasing its procurement of Chinese‑made components for its factories in Thailand to stay cost‑competitive.

Trade Tensions and Tariff Battles

China’s rise is prompting a wave of protectionist measures. The United States and Canada have imposed tariffs exceeding 100 % on Chinese‑origin electric cars, and the EU is considering duties up to 45.3 %. In response, the EU is drafting lighter technical standards for small‑size EVs to stimulate domestic production and protect European manufacturers.

What 2025 Could Look Like for the Auto Industry

If the forecasts hold, 2025 will mark the first year that a Chinese automaker leads the world in total vehicle sales. The shift will intensify competition among the traditional “Big Three” – the United States, Europe, and Japan – and may reshape supply chains, R&D priorities, and market‑entry strategies for years to come.

Stakeholders worldwide should watch closely as pricing wars, policy changes, and rapid EV adoption converge to redraw the global automotive map.